Are you wondering whether securing rentals or owning property is the smarter choice for you? This decision can shape your financial future and affect your peace of mind.

You might feel torn between the flexibility of renting and the stability of ownership. What if you could clearly see the benefits and risks of each option before making your move? Keep reading, because understanding these differences could save you money, stress, and time.

By the end, you’ll feel confident about what fits your lifestyle and goals best.

Renting Benefits

Renting a home offers many advantages over buying. It can suit different lifestyles and budgets. People choose renting for its ease and lower risks.

This guide covers key benefits of renting, such as flexibility, cost savings, and less responsibility for repairs.

Flexibility And Mobility

Renting allows you to move easily for work or personal reasons. You are not tied down by a long-term commitment.

Lease terms are often shorter than mortgages. You can change locations without selling a property.

- Move quickly if job changes

- Try new neighborhoods or cities

- Adjust home size as life changes

Lower Upfront Costs

Renting needs less money at the start. Usually, you pay a security deposit and first month’s rent.

Buying a home requires a large down payment and closing fees. Renting keeps your savings for other needs.

- Small deposit vs. big down payment

- No loan application or credit checks

- Save money for emergencies or travel

Maintenance And Repairs

Renters are not responsible for major repairs. The landlord handles maintenance and fixes issues.

This means you do not pay for broken appliances or structural problems. It lowers your stress and costs.

- Landlord fixes leaks and damages

- No extra bills for repairs

- Less time spent on upkeep

Credit: www.hindustantimes.com

Ownership Advantages

Owning a home has many benefits that renting does not offer. It gives you a chance to build something valuable over time.

Here are some important advantages of owning your home instead of renting.

Building Equity

Equity is the money you own in your home. Each payment you make increases your equity.

Renting only pays for use, but owning builds wealth for the future.

- Monthly mortgage payments grow your ownership stake

- Home value may rise over time

- Equity can be used for loans or other needs

Creative Freedom

When you own your home, you can change it as you like. You decide how to decorate or renovate.

Renters usually need permission and face many rules about changes.

- Paint walls any color

- Change fixtures and furniture

- Build additions or improve landscaping

Long-term Financial Gains

Owning a home can save money over many years compared to renting. Property may also increase in value.

Long-term ownership helps with financial stability and future planning.

- Fixed mortgage payments protect against rent hikes

- Home value may grow, adding to your wealth

- Possible tax benefits from home ownership

Financial Comparison

Deciding between securing a rental or owning a home has many financial effects. Understanding these effects helps in making the right choice.

This comparison looks at costs, taxes, and how property values change over time.

Monthly Expenses

Renters pay a fixed monthly rent that usually covers housing costs only. Owners pay a mortgage plus extra costs.

Homeowners have more bills like maintenance and insurance, making monthly costs higher.

- Renters: rent, utilities (sometimes)

- Owners: mortgage, property taxes, insurance, upkeep

Tax Implications

Renters do not get tax benefits from paying rent. Owners can deduct mortgage interest and property taxes.

Tax savings can reduce the net cost of owning a home but depend on local laws and personal tax situations.

- Renters: no tax deductions

- Owners: mortgage interest and property tax deductions

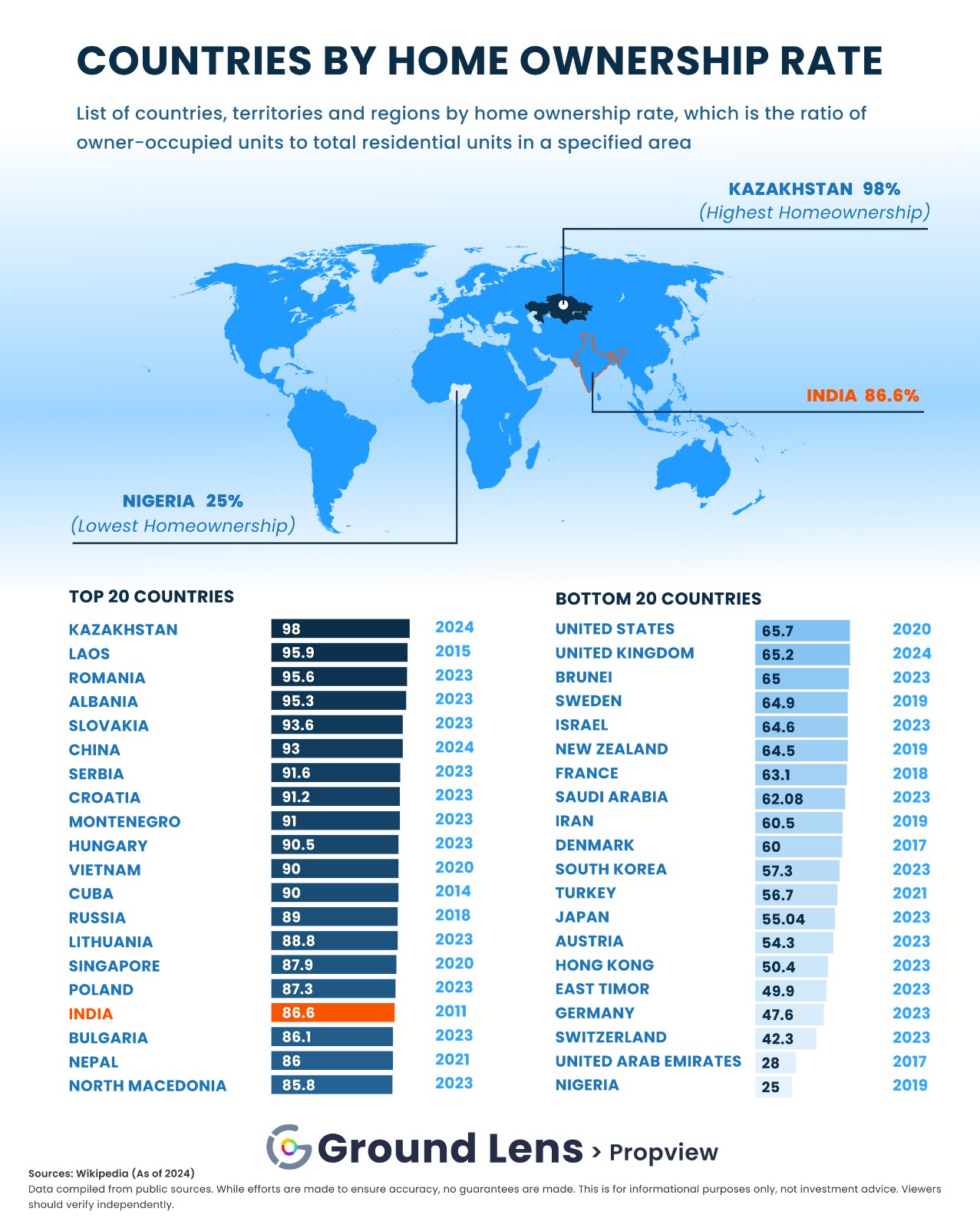

Market Value Trends

Renters do not gain or lose from property value changes. Owners can build equity if values rise or lose if values fall.

Owning a home is also an investment, but market risks can affect financial stability.

- Renters: stable housing cost, no property value risk

- Owners: potential equity gain or loss based on market

Credit: better.co.uk

Lifestyle Considerations

Choosing between renting and owning a home affects your daily life. Both options come with different lifestyle benefits and challenges.

Think about what fits your needs and habits before deciding. Your lifestyle goals matter in this choice.

Stability And Community

Owning a home usually offers more stability. You can stay in one place for years and build strong community ties.

Renting can mean more moves and less chance to join a neighborhood deeply. But it can also let you try new areas easily.

- Owners often feel more connected to neighbors.

- Renters may move frequently, limiting community bonds.

- Homeownership can lead to long-term local friendships.

Space And Customization

Owners can change their homes as they like. They can paint walls, remodel rooms, and add personal touches.

Renters face limits on changes. Many landlords do not allow major alterations or decorations.

- Homeowners can create spaces that fit their lifestyle perfectly.

- Renters must follow rental rules on home changes.

- Customization helps make a house feel like home.

Commitment Levels

Owning a home is a big commitment. It requires time, money, and long-term planning.

Renting offers more flexibility. You can move easily and avoid some financial risks.

- Homeowners commit to mortgage payments and maintenance.

- Renters pay rent with less responsibility for repairs.

- Renting suits those who prefer short-term living plans.

Risk Factors

Choosing between renting and owning a home involves risks. Understanding these risks helps you make better decisions.

Both renting and owning have risks that affect your money and lifestyle. Knowing these risks is important.

Market Fluctuations

Housing markets change often. Prices can go up or down quickly. Owners face risks if property values drop.

Renters usually have fixed costs for a lease term. But rent can rise when leases end or markets change.

- Owners may lose money if property value falls

- Renters may face higher rent after lease ends

- Both must watch economic trends closely

Unexpected Costs

Owning a home means paying for repairs and maintenance. These costs can be big and happen without warning.

Renters usually have fewer surprise expenses. Landlords often cover repairs, but renters may pay for small damages.

- Homeowners pay for repairs and upkeep

- Renters pay rent and small damage costs

- Unexpected costs can strain budgets

Lease Restrictions

Renters must follow lease rules. These rules limit changes and use of the property. Breaking rules can cause eviction.

Owners have more freedom to change their home. They can remodel or decorate without asking permission.

- Renters face limits on pets, noise, and changes

- Owners control their property fully

- Lease rules affect renters’ lifestyle choices

Decision-making Tips

Deciding between renting and owning a home is a big choice. It affects your finances and lifestyle.

Think about your needs carefully. This guide helps you make a clear choice.

Assessing Personal Goals

Know what you want from your living situation. Do you want flexibility or stability?

Consider your plans for work, family, and travel. Your goals affect whether renting or owning fits better.

- Renting offers freedom to move often

- Owning builds long-term stability

- Think about how long you plan to stay

- Consider if you want to customize your home

Calculating Total Costs

Look beyond monthly rent or mortgage payments. Include all costs to compare fairly.

Calculate expenses like taxes, insurance, repairs, and utilities. These add up over time.

| Cost Type | Renting | Owning |

|---|---|---|

| Monthly Payment | Rent | Mortgage |

| Maintenance | Usually landlord pays | Owner pays |

| Insurance | Renter’s insurance | Homeowner’s insurance |

| Property Taxes | Not paid by renter | Paid by owner |

| Utilities | Sometimes included | Owner pays |

Seeking Professional Advice

Talk to real estate agents, financial advisors, or lawyers. They can explain details you might miss.

Professionals help you understand contracts and local market trends. Their knowledge reduces risks.

- Ask about hidden fees

- Request advice on loan options

- Get help with legal documents

- Learn about neighborhood growth

Credit: inspakt.com

Frequently Asked Questions

What Are The Main Security Differences Between Rentals And Owned Homes?

Owned homes offer more control over security measures. Rentals often rely on landlords for safety upgrades. Ownership allows personalized security systems, while rentals may have limited modifications. This impacts the overall protection level of the property.

How Does Insurance Vary For Secured Rentals Vs Owned Properties?

Insurance for owned properties covers a wider range of risks. Rental insurance typically focuses on tenant belongings and liability. Owners invest in comprehensive policies, while renters have more limited protection. This affects financial security in case of damage or theft.

Can Renters Improve Security As Effectively As Homeowners?

Renters can enhance security with portable devices like alarms and cameras. However, they face restrictions on permanent installations. Homeowners have freedom to install advanced security systems. Both can increase safety, but homeowners have more options for customization.

Why Is Securing Owned Properties Often Considered More Cost-effective?

Securing owned homes is a long-term investment that increases property value. Renters may spend repeatedly on temporary security solutions. Ownership allows for tailored, durable security installations. This reduces ongoing costs and improves overall safety over time.

Conclusion

Deciding between renting or owning depends on personal needs and goals. Renting offers flexibility and fewer responsibilities. Ownership provides stability and potential financial growth. Consider lifestyle, budget, and long-term plans before choosing. Both options have their benefits and challenges. It’s crucial to weigh these carefully.

Understanding your priorities can guide you to the right decision. Ensure your choice suits your current situation and future aspirations. Remember, the right option varies for everyone. Choose wisely for peace of mind and satisfaction.

15 min read